crypto tax calculator nz

This way if you are a newbie starting now you get to use free ones and test how you like them. Enter the price for which you purchased your crypto and the price at which you sold your crypto.

Crypto Tax Calculator Review June 2022 Finder Com

Over 600 Integrations incl.

. Record keeping for cryptoassets. Crypto tax calculators are used by crypto enthusiasts all over the world to help automate their crypto and bitcoin tax reporting. For New Zealand customers we recommend reading our 2022 NZ crypto tax guide.

Janes estimated capital gains tax on her crypto asset sale is 1625. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. Work out your cryptoasset income and expenses.

Rated 46 with 700 Reviews. Over one million people trust Bitget to buy sell cryptocurrencies. Generate ready-to-file tax forms including tax reports for Forks Mining Staking.

An unrealised profit is when the market value of a token is higher than the original. Working out your cryptoasset income and expenses. Calculating the New Zealand dollar value of cryptoassets.

Crypto Tax Calculator is an Australian-based crypto tax software platform that operates with a subscription model allowing you to calculate taxes for previous tax years starting from 2013. Some cryptoasset transactions may not have an NZD value such as. Check out our free guide on crypto taxes in New Zealand.

Coinpanda generates ready-to-file. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. Most places offer both free and also premium tax calculations.

When you exchange the BTC for ETH disposal of the BTC happens and you need to calculate the price difference of the BTC in NZD between when you bought it with NZD and disposed of it for ETH. Check out our free guide on crypto taxes in New Zealand. Calculate Your Crypto DeFi and NFT Taxes in Minutes.

The table below shows the different tax rate for each income bracket. Free vs paid crypto tax calculators. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

See our 500 reviews on. Refer to the differences in tax payable in example 3 and 4 below. Koinly helps New Zealanders calculate their income from crypto trading Mining Staking Airdrops Forks etc.

The tax rate on this particular bracket is 325. Selling crypto for fiat eg NZD is a taxable event examples below Trading one coin for another is a taxable event. This new rate applies from 1st April 2021 according to the Inland Revenue.

Founded by the mighty Craig MacGregor co-founder of Navcoin and a legend in the NZ Crypto scene Taxoshi is a homegrown tax calculation service that makes it easy for you to meet your NZ Crypto tax obligations. Using crypto to purchase goods or services is a taxable event. No notepads and calculators are needed here.

Before you can put your cryptoasset net income or loss in your tax return you need to. New Zealand users we understand that filing crypto taxes can be both confusing and time-consuming. The New Zealand tax.

You need to file a tax return when you have taxable income from your cryptoasset activity. For the latest information about tax and crypto please engage a tax accountant andor the IRD. For each dollar of income.

To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status. This information is current as at the date of publication. Get Started For Free.

0325 5000 1625. Compare different crypto tax softwares by compatibility with exchanges like Binance Coinbase FTX Kraken Kucoin Huobi. Check out this table to know how to calculate your taxes.

Just make sure to import all relevant transactions and the Crypto Tax calculator. The disposal of crypto is the taxable event and the profit or loss is calculated in New Zealand Dollars at the time of disposal. The IRD has now published guidance to explain how New Zealands existing tax laws should be applied to bitcoin and other cryptocurrencies.

You simply import all your transaction history and export your report. Calculate the New Zealand dollar value of your cryptoasset transactions. Quick simple and reliable.

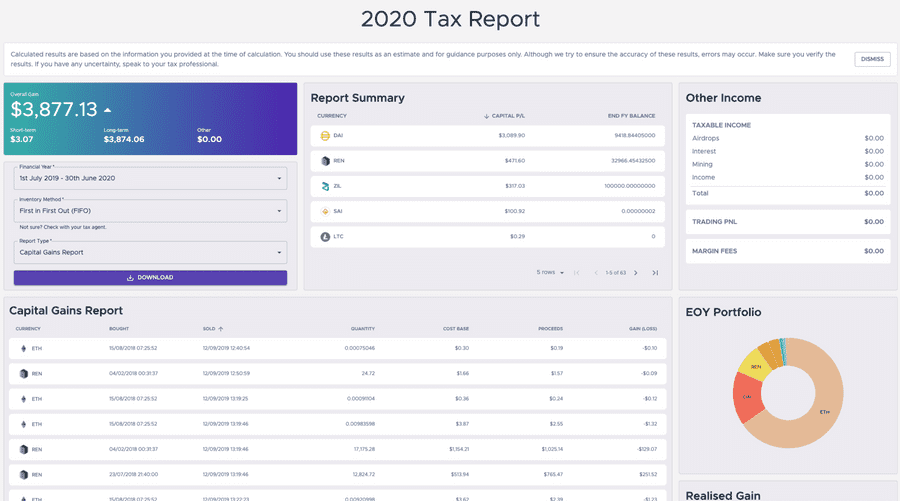

Income report - Mining staking etc. From 1 up to 14000. You can discuss tax scenarios with your accountant.

Our step by step wizard and cryptocurrency tax calculator is fine-tuned for New Zealand and will help you figure out your crypto tax position to declare. Although it has a 30-day free trial that supports 10000 transactions you must pay to retrieve your Form 8949 and Schedule 1. Capital gains tax report.

In 2014 the IRS decided to treat cryptocurrencies like stocks and bonds rather than currencies like dollars or euros. File your crypto taxes in New Zealand. We have a list of certified tax accountants in New Zealand that specialize in cryptocurrencies.

Citizens from New Zealand have to report their capital gains from cryptocurrencies. Buying crypto is not a taxable event see example 2 below. Crypto CPAs in New Zealand.

The amount of tax you need to pay depends on how much income you have. With the end of tax year coming up on the 7th of July next month Taxoshis automated. Ad Bitget is The Best Place to Buy Crypto Without Verification or ID Anonymously.

Taxoshi NZs Crypto Tax Caluclator. Once all transactions are loaded in and reviewed it takes just a single click to generate a full crypto tax report. Compliant with Australian tax rules.

Find the right crypto tax calculator to help do your crypto taxes in New Zealand. From 14001 up to 48000. Taxoshi is a cryptocurrency tax calculator focused on helping kiwis understand their tax position.

Hes a tax specialist with more than 25 years experience and produces a weekly podcast on all things tax often branching into what that means in the world of crypto. Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax calculators and talk in-depth about crypto taxing. Without knowing an individuals total income from all sources we cannot calculate how much tax there is to pay because it depends on the individuals total income not just crypto income.

Therefore your assets of crypto are taxed whenever they. Cryptoassets and GST goods and services tax You need to use amounts in New Zealand dollars NZD when filing your income tax return. Crypto Trading in New Zealand is Below Average.

If youre looking for a way to track your. Coinpanda lets New Zealanders calculate their capital gains with ease. We quizzed both of these experts on some common questions users ask crypto exchange Swyftx NZ the sponsor of this article.

Be sure to add how long youve owned the cryptocurrency.

Crypto Tax Calculator 2021 Platform Review

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Crypto Tax Calculator Home Facebook

5 Best Crypto Tax Software Accounting Calculators 2022

Crypto Tax Calculator 2021 Platform Review

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Best Coinbase Tax Calculator 2022

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

Crypto Tax Calculator 2021 Platform Review

Best Coinbase Tax Calculator 2022

Crypto Tax Calculator Review June 2022 Finder Com

Cryptocurrency Taxes What To Know For 2021 Money

Crypto Tax Calculator Home Facebook

Crypto Tax Calculator 2021 Platform Review

Best Crypto Tax Software Top Solutions For 2022

Crypto Tax Calculator 2021 Platform Review

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Earn More Money Free Money